Tables

GL Codes

System Location: Settings > Tables > GL Accounts

GL (General Ledger) Accounts, also referred to as GL Codes, are used to sort and store information associated with financial transactions, most notably on reports such as the Balance Sheet, Income Statement, General Ledger Summary, Trial Balance, and a variety of costing summaries. The complete list of GL Codes created makes up a company's Chart of Accounts.

Given that GL Codes are required throughout JobBOSS2 and the role they play on a large number of production related reports such as the Inventory Summary, WIP Summary, and Job Cost Summary, it is STRONGLY suggested that the entire chart of accounts be entered even if accounting functions are being handled outside of JobBOSS2.

Related Tables

The following Tables and / or Base Tables are used on GL Codes (an asterisk [*] indicates it is a required field on this Table):

- *GL Group Codes

- *Currency Codes

- GL Codes (Accumulation Account)

Associated Reports

Record Header - GL Code

Record Header - GL Code

The Record Header located at the top of the page indicates which specific record has been selected and for what purpose (new, edit, quick view)

For more information see User Interface.

Action Buttons

Audit Trail (button)

This option displays information regarding activity that has taken place on the selected General Ledger Code.

Audit Trail Button Details

This option displays information regarding activity that has taken place on the selected record.

- Provides the following information:

- User: Indicates who performed the Action

- Action: Indicates what the User did

- NEW: Used when the record is created

- EDIT: Used when the record is closed by clicking OK - even if nothing was changed on the record

- VIEW: Used when the record is closed by clicking Cancel

- Date: Indicates when the Action took place

- Information can only be viewed, not edited or deleted

- An Audit Trail Summary can be printed by going to Reports > G/L > Audit Trail Summary within the system.

For more information see Audit Trail.

Save (button)

Save Button Details

This button is used to close the record and save any changes that have been made while it was open. In addition, the dropdown button allows you to Save and:

- Close - close the open record.

- New - open a new blank record.

- Print - print any of the reports related to the open record.

Cancel (button)

Cancel Button Details

This button is used to close the record without saving any changes that may have been made while it was open. If this button is used after a change has been made to the record, the system prompts to verify whether the record should be closed without saving the changes.

Answering "Yes" to the prompt closes the record without saving the changes.

Answering "No" to the prompt leaves the record open.

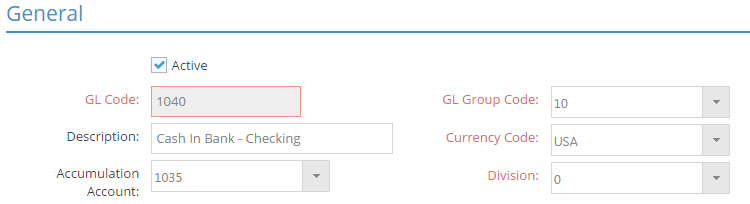

General Section

General Section

The General Section is used to provide identifying information for the GL code in addition to values that determine how and where it displays with regards to financial reports.

An asterisk [*] indicates a required field.

Active

Checking this box indicates the GL Code should be considered as an active account.

- Searches for "ALL" records include only active GL Codes by default

- Can be used as a search filter

- Remove check for GL Codes that are no longer used

- Remain in system but do not appear in search results unless specifically filtered to do so

*GL Code

This is the value assigned to each account included in the general ledger.

- Can be up to 12 alpha-numeric characters

- Must be unique for each GL Code

Description

This information appears on financial reports and costing summaries as a means of easily identifying what the GL Code represents.

- Can be up to 30 alpha-numeric characters

Accumulation Account

Select another GL Code here in order to combine this and other related GL Codes as a summarized value when printing consolidated balance sheets or income statements.

- Do not create an "Accumulation Account Loop" by selecting the GL Code being edited as its own Accumulation Account

If Accumulation Accounts are used to generate consolidated financial reports, it is recommended to create "standalone" accounts that do not have actual activity associated with them to avoid confusion. For example, create an "Accumulated Cash" account that serves no other purpose than to display the combined value of all cash accounts on a consolidated balance sheet.

*GL Group Code

This field is used to organize the GL Code within the overall chart of accounts. Assigning a GL Group Code determines the following:

- The type of account the GL Code is associated with (asset, liability, etc.)

- Also determines whether the GL Code appears on balance sheet or income statement

- The position on the financial report the GL Code appears

- Lower GL Group Code numbers appear before higher ones

- Each GL Group Code entry will also display a sub-total on the appropriate financial report

*Currency Code

This identifies the currency associated to the GL Code.

- Defaults to the Currency Code designated in Company Maintenance

- Could be edited for GL Codes associated with foreign currency accounts for reconciliation purposes

*Division

This field allows for the creation of divisional income statements and balance sheets.

- Defaults to zero (0) which represents consolidated or non-divisional information

- Divisions are defined in Company Maintenance Defaults

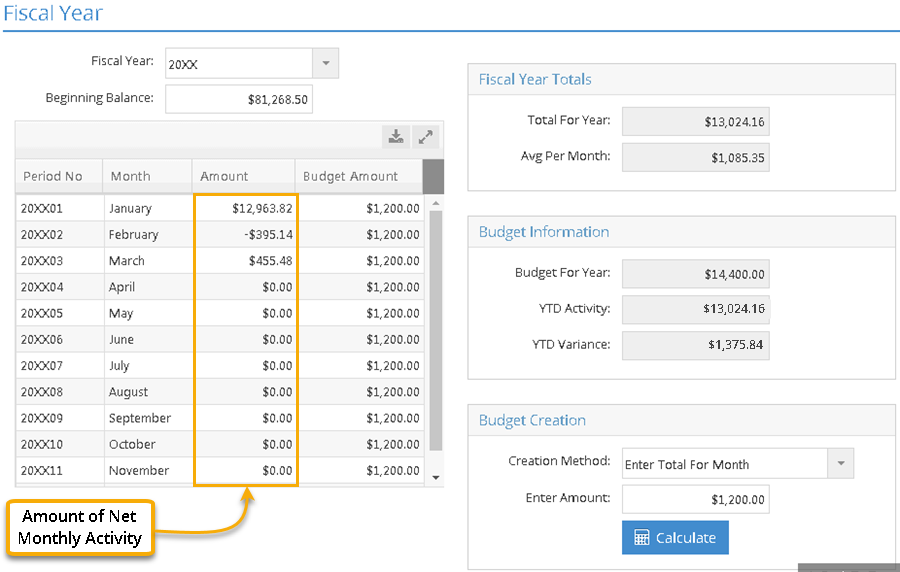

Fiscal Year Section

Fiscal Year Section

This section displays the balance related details of the GL Code for the selected Fiscal Year.

Fiscal Year

This dropdown menu provides the ability to choose which year's information is displayed in the Fiscal Year Grid and the various boxes provided here.

- Fiscal Years are defined in Company Maintenance.

- Only Fiscal Years that are NOT marked as 'Historical Years' will appear in the dropdown menu.

- Fiscal Years that are Closed but still available to view cannot have their Beginning Balances edited.

- Selecting a future Fiscal Year allows for the creation of budgets in advance.

For more information see Fiscal Year Settings - Reference Information.For more information see How To Mark a Fiscal Year As Historical.

Beginning Balance

This field represents the opening balance of the GL Code as of the first day of the current fiscal year. The value listed here could be zero ($0.00), a "positive" amount, or a "negative" amount.

- Zero (0): This is typically the case for income and expense related GL Codes.

- These GL Codes could display an opening balance value other than 0 when implementing the Accounting Application if doing so part way through the current fiscal year.

- A "positive" amount: Dollar amounts listed like the one in the image above indicate the GL Code had an opening debit balance, which would typically be the case for asset accounts.

- A "negative" amount: Dollar amounts listed like the one in the image below indicate the GL Code had an opening credit balance, which would typically be the case for liability and equity accounts.

The presence of a "minus symbol" represents a credit balance and the lack of one represents a debit balance. The presence or absence of the minus symbol does NOT in itself indicate the account is in the "wrong direction" or is "OK" since different accounts carry different kinds of balances by nature. For example, equity accounts would carry a credit balance, which would be represented with a minus symbol.

- This value is manually entered when accounting is implemented as appropriate.

- Once implemented, the system automatically sets this value for each new fiscal year based on the type of account:

- Asset and liability accounts are populated with the ending balance of the previous year

- Retained Earnings (as designated in Company Maintenance Defaults) is increased or decreased by the amount of Current Earnings for the previous year

- Current Earnings (as designated in Company Maintenance Defaults), income, and expense accounts all start with a zero balance

- Once implemented, the system automatically sets this value for each new fiscal year based on the type of account:

- For more information see How To Implement Accounting in JobBOSS2.

Fiscal Year Grid

Period Number

These values identify each accounting period within the selected Fiscal Year.

- Each Period must be unique.

- Period Numbers are assigned / edited within Fiscal Year Settings (located under Company Maintenance.)

Month

This field indicates which month of the year the associated Period covers.

- Periods are associated with specific months in Fiscal Year Settings (located under Company Maintenance.)

Monthly Amount Values (January through December)

These fields represent the net debit or credit activity for the GL Code for each month within the selected Fiscal Year.

- A minus symbol indicates net credit activity; the lack of one indicates net debit activity.

- The Period must be posted in order for all activity to be fully accounted for.

- Activity for the GL Code included in Journal Entries will display regardless of the Period's posted status, but no other transactions will.

- The sum of the amounts listed in the monthly fields (up to the desired month) is added to or subtracted from the Beginning Balance amount to determine the beginning balance for each month.

- For example, to determine the opening balance for February, the sum of the January and February activity fields would be added to or subtracted from the Beginning Balance amount. To determine the balance at the end of the year, the sum of all 12 months would be added to or subtracted from the Beginning Balance amount.

- These values determine what displays on financial reports such as the balance sheet and income statement.

- These fields are system maintained and cannot be edited once accounting is implemented.

The values listed next to each month DO NOT represent the opening balance for that month, but rather the net debit or net credit amount of activity that occurred during that month.

Budget Amount (January through December)

These values represent the anticipated monthly activity for each Period within the selected Fiscal Year that can be used to create budget analysis reports.

- A minus symbol indicates anticipated net credit activity; the lack of one indicates anticipated net debit activity.

- The amounts listed can be used to compare actual activity against budgeted activity by running the Budget Analysis Summary.

- These fields are can be populated in one of two ways:

- By using the Budget Creation utility (see below)

- Manually entering a value for one or more months as desired

Budget Creation Box (Utility)

This utility allows for all the Periods in the selected Fiscal Year to be populated with budget figures at one time by using one of the methods listed below.

Creation Method (Dropdown menu)

The following methods can be used to populate the monthly activity fields:

- Enter Total For Year

- When this method is selected, an amount representing the activity of the entire year is entered in the Enter Amount field.

- When the Calculate button is clicked, the utility divides the total by 12 and places the resulting amount in each of the monthly Budget Amount fields.

- Enter Total For Month

- When this method is selected, an amount representing the anticipated average amount of each month is entered in the Enter Amount field.

- When the Calculate button is clicked, the utility enters that amount directly into each of the monthly Budget Amount fields.

- Use Last Year's Average

- When this method is selected, the utility looks to the previous Fiscal Year to determine the Current year's budget amounts.

- When the Calculate button is clicked, the utility applies the value from the Avg Per Month field of the previous Fiscal Year into each of the monthly Budget Amount fields.

- As noted previously, values can be manually entered into one or more of the monthly activity fields as well.

Note Regarding Future Years' Budget Values

If budget values have not been entered for the "next" Fiscal Year, budget values entered for the Current Year will be copied and used when the current year is closed.

If budget values are modified in a future Fiscal Year, they will remain in place and will not be overwritten when the current year is closed.

Budget Information Box

This information is used to compare actual year to date activity with budgeted year to date activity for the selected Fiscal Year.

Budget For Year

Represents the sum of all the budgeted monthly activity fields.

YTD Activity

This is the Total For Year value pulled from Fiscal Year Totals.

YTD Variance

This represents the variance between the two values listed here.

- This value will be most meaningful at the end of the year.

Fiscal Year Totals Box

Total For Year

This represents the total net amount of year to date activity that has taken place in the GL Code during the selected Fiscal Year.

- As with monthly values, a minus symbol indicates net credit activity to date and the lack of one indicates net debit activity to date.

- This is a system calculated value and cannot be edited.

Avg Per Month

This represents the average monthly debit or credit activity associated with the GL Code for the selected Fiscal year.

- Determined by dividing the value listed as the Total For Year by the number of months present.

- Though this would typically be 12, it could be less if dealing with a shortened accounting year for implementation purposes.

- This is a system calculated value and cannot be edited.