Historical Year; Accounting Setup Complete; Fiscal Year Type

Fiscal Year Settings - Reference Information

This topic is designed to provide information related to the fields and features available within the selected area and is not intended to be a process document. Check the “Additional Topics” dropdown menu provided to see what additional information may be available for review.

System Location: Settings > System > Company Maintenance > Fiscal Year Settings

Fiscal years represent the various time frames used for accounting purposes and the preparation of annual financial statements within JobBOSS2. Each fiscal year covers a 12 month period and is made up of multiple periods that can represent calendar months or custom designed time frames for businesses that utilize 4-4-5 (or similar) accounting practices.

When first implementing accounting in JobBOSS2, it is possible to create separate “short years” that cover 12 months when taken together in order to account for open invoices and unreconciled checks.

For more information see How To Implement Accounting in JobBOSS2.

Fiscal Years Header

Fiscal Years Header

The Header located at the top of the page indicates what area has been selected and displays record specific Action Buttons.

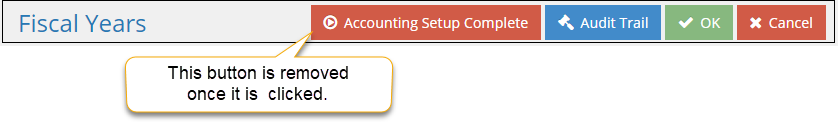

Accounting Setup Complete (Conditional Option - New Systems Only)

This button is available in all new instances of JobBOSS2 as a part of the accounting implementation process. Systems that have this option available are considered to be in "Accounting Setup mode."

- While in Accounting Setup mode, the system behaves as follows:

- Periods for historical years display in Period Number dropdown menus on accounting records, meaning they can be accessed for viewing, printing, and editing purposes.

- Process Accounting Functions (located under GL > Journals > Process) are not available for use.

- Periods cannot be posted, unposted, or locked.

- Fiscal years cannot be posted.

- You can “manually” close years by placing a check in the Closed Year box located in the Fiscal Year Detail section.

- You can select and deselect this option as desired prior to clicking the Accounting Setup Complete button.

- Certain values in general ledger accounts (located under Tables > GL Accounts) are available for editing that are normally "locked."

- The Amount values for listed periods can be edited as a way to account for previous years' activity.

- The Beginning Balance value can be edited for any fiscal year (since they cannot be closed.)

- You cannot perform a bank reconciliation.

- Once the Accounting Setup Complete button has been clicked (i.e. you are no longer in Accounting Setup mode,) the system behaves as follows:

- The system removes the Accounting Setup Complete button from the Fiscal Years Header Action Bar.

- Periods for historical years do not display in Period Number dropdown menus on accounting records, meaning they cannot be accessed for viewing, printing, or editing purposes.

- Years marked as Historical AFTER the Accounting Setup Complete button has been used can have the Historical designation removed to allow for the viewing / printing of related information and reports, even after they are closed.

- Years marked as Historical BEFORE clicking the Accounting Setup Complete button cannot have the Historical Year option removed AFTER the Accounting Setup Complete button has been used.

- Process Accounting Functions are available for use (posting, unposting, locking, etc.)

- You cannot “manually” close a year by placing a check in the Closed Year box located in the Fiscal Year Detail section.

- An exception to this behavior is allowed when you are using either of the QuickBooks interface options. This is done so that you can “close” years in JobBOSS2 to avoid receiving prompts about entering accounting records outside of your current fiscal year since you do not have the ability to post years if you do not have the JobBOSS2 accounting application.

- GL Account Amounts are calculated by the system based on the activity present within each period and cannot be edited directly.

- Beginning balances cannot be edited for closed years.

Systems converted from a previous version of JobBOSS2 will also have Accounting Setup Complete option available. Assuming you were already using accounting and there were no date discrepancies encountered during conversion, the new Shop instance of JobBOSS2 should be ready to go and you can click the Accounting Setup Complete button straight away.

However, if you see a “gap” in fiscal years after the conversion, contact support for assistance in identifying where the incorrect date is pulling from before clicking the Accounting Setup Complete button.

Audit Trail

This option displays information regarding activity that has taken place within the selected Company's Fiscal Years.

Audit Trail Button Details

This option displays information regarding activity that has taken place on the selected record.

- Provides the following information:

- User: Indicates who performed the Action

- Action: Indicates what the User did

- NEW: Used when the record is created

- EDIT: Used when the record is closed by clicking OK - even if nothing was changed on the record

- VIEW: Used when the record is closed by clicking Cancel

- Date: Indicates when the Action took place

- Information can only be viewed, not edited or deleted

- An Audit Trail Summary can be printed by going to Reports > G/L > Audit Trail Summary within the system.

For more information see Audit Trail.

OK

Save Button Details

This button is used to close the record and save any changes that have been made while it was open. In addition, the dropdown button allows you to Save and:

- Close - close the open record.

- New - open a new blank record.

- Print - print any of the reports related to the open record.

Cancel

Cancel Button Details

This button is used to close the record without saving any changes that may have been made while it was open. If this button is used after a change has been made to the record, the system prompts to verify whether the record should be closed without saving the changes.

Answering "Yes" to the prompt closes the record without saving the changes.

Answering "No" to the prompt leaves the record open.

Select Fiscal Year Section

Select Fiscal Year Section

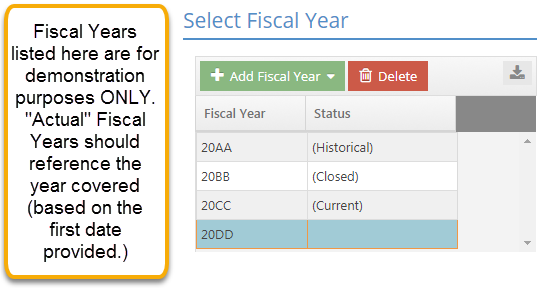

This grid displays all the fiscal years that have been created for the selected company and indicates the status of each one with regards to its availability for use and for report generation purposes.

Action Buttons

Add Fiscal Year

This dropdown menu allows for the creation of fiscal years. Options include:

- Before: Creates the fiscal year before the one currently selected in the grid.

- After: Creates the fiscal year after the one currently selected in the grid.

- These values display so long as at least one fiscal year is already present in the grid.

- New: Creates a new fiscal year.

- This value only displays if there are no fiscal years present in the grid.

The system will not create a fiscal year if one already exists in the location selected. For example, a fiscal year could not be created between the years "20BB" and "20CC" in the image above, assuming “BB” and “CC” represented consecutive years.

Since the system automatically creates a fiscal year for the "next year" when the current one is closed, this option would typically be used only when implementing the accounting application or if you need to switch how your fiscal years are defined for future time frames after you have already implemented accounting.

Delete

This option can be used to remove a fiscal year from the grid so long as it has no activity associated with it.

Fiscal years that have any accounting related activity present cannot be deleted.

Select Fiscal Year Grid

Values in this grid are read only and cannot be edited directly.

Fiscal Year

This column identifies the fiscal years that have been defined for the selected company.

- The system provides three years by default based on the date the JobBOSS2 Company was created.

- Selecting a year in this grid determines what information displays in the Fiscal Year Detail section and its related grid, which is where information related to the year can be edited.

Status

This value indicates the availability of the fiscal years within JobBOSS2. Options include:

- Closed: The year has been closed / posted.

- No accounting records can be created in any of the periods associated with the fiscal year.

- Associated periods display in Period Number dropdown menus on accounting records for purposes of viewing information and printing core financial reports.

- Core financial reports are considered to be the balance sheet, income statement, general ledger summary, and trial balance.

- To prevent associated periods from displaying in dropdown menus, it would need to be marked as a Historical Year using the checkbox located in Fiscal Year Detail section.

- Historical: The year has been marked as a Historical Year in the Fiscal Year Detail section.

- The behavior of these years depends on when they were marked as historical and whether accounting is in setup mode or not.

- Closed, Historical: The year has been closed / posted and marked as a Historical Year (in the Fiscal Year Detail section.)

- No accounting records can be created in any of the periods associated with the Fiscal Year.

- The behavior of these years depends on when they were marked as historical and whether accounting is in setup mode or not.

See the Fiscal Years Header section of this topic for information regarding the behavior of JobBOSS2 based on whether you are in Accounting Setup mode or not.

- Current: Identifies the year that is considered the current one and will be closed when the Post Year option is used (located in Process Accounting Functions under GL > Journals.)

- Accounting records can be entered in any unposted period within the year.

- AR and AP records cannot be entered in any posted or locked period within the year.

- Journal entries can be entered into a posted period.

- Associated periods display in Period Number dropdown menus on accounting records for purposes of viewing, editing, and printing reports.

- BLANK (Nothing listed): Indicates a future fiscal year.

- At least one future year must be available at all times.

- Periods from the "next" fiscal year will display in the Process Accounting Features grid for purposes of entering accounting records during the transition between years.

- Accounting records can be entered in any unposted period within a future year.

- Accounting records cannot be entered in any posted or locked period within a future year.

- Associated periods display in Period Number dropdown menus on accounting records for purposes of viewing, editing, and printing reports.

The system automatically creates the "next" fiscal year when the one marked as Current is posted if one does not already exist.

Fiscal Year Detail Section

Fiscal Year Detail Section

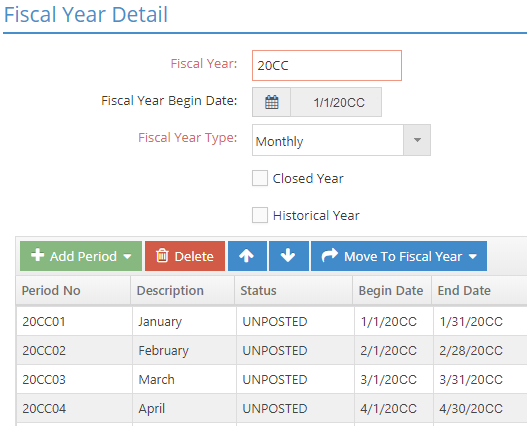

This section and the associated grid is where the selected fiscal year can be marked as historical and where its periods can be defined.

Fiscal Year

This value identifies which year's details are displayed in the Fiscal Year Detail grid.

- This field is populated based on which fiscal year is selected in the Select Fiscal Year grid.

- The default fiscal year value assigned by the system can be edited; however we recommend that it includes a date reference based on the Begin Date of the first period associated with it.

- Fiscal Year values must be unique.

Fiscal Year Begin Date

This read only value displays the Begin Date provided for the first period defined in the Fiscal Year Detail grid and represents the first day of the selected fiscal year.

Fiscal Year Type

Use this dropdown menu to determine how periods are defined within your fiscal years.

- Monthly: This setting results in periods that match the calendar month.

- This is the default setting.

- 4-4-5: This setting results in periods that follow the 4 week, 4 week, 5 week pattern.

- 4-5-4: This setting results in periods that follow the 4 week, 5 week, 4 week pattern.

- 5-4-4: This setting results in periods that follow the 5 week, 4 week, 4 week pattern.

- 13 Period: This setting results in 13 periods of 4 weeks each.

Every fiscal year will have an additional Adjustment Period provided regardless the Fiscal Year Type selected.

If you use non-monthly periods, it is important to define your fiscal years and their periods BEFORE entering any records in the accounting area of JobBOSS2.

For more information see How To Create Non-standard Fiscal Years.

Contact support if you need to switch from one Fiscal Year Type to another after accounting records have already been created and fiscal years are set.

Support Contact Info:

800-677-9640

Closed Year

A check in this box indicates the selected year has been posted (closed) in the Process Accounting Function area of JobBOSS2.

- This value is system maintained and cannot be edited once the Accounting Setup Complete button has been clicked.

Historical Year

When this option is selected, periods associated with the selected year will not display in Period Number dropdown menus on accounting records.

- Years marked as Historical while in Accounting Setup mode cannot have the designation removed once the Accounting Setup Complete option is used.

- Years created as a result of converting from a previous version of JobBOSS2 cannot have the designation removed.

- Years marked as Historical after the Accounting Setup Complete option was used can have the designation removed and replaced as desired.

See the Fiscal Years Header section of this topic for additional information regarding the behavior of JobBOSS2 based on whether you are in Accounting Setup mode or not.

Fiscal Year Detail Grid

Action Buttons

Add Period

This dropdown menu allows for the creation of additional periods within the selected year. Options include:

- Before: Creates the period before the one currently selected in the grid.

- After: Creates the period after the one currently selected in the grid.

The system will not create a period if one already exists in the location selected. For example, a Period could not be created before or after "20CC03" in the image above.

Delete

This option can be used to remove a period from the grid so long as it has no activity associated with it.

Periods that have any accounting related activity present cannot be deleted.

Unless operating in a shortened fiscal year due to implementation of the accounting application or as a way to account for non-calendar fiscal years, there is no need to add or remove periods as the system automatically creates them when a new fiscal year is created.

"Up Arrow"

This option is used to move the selected period up one spot in the grid each time it is clicked.

"Down Arrow"

This option is used to move the selected period down one spot in the grid each time it is clicked.

If Periods are moved, Begin Date values should be adjusted to avoid date ranges being "out of sync" within the fiscal year.

Move To Fiscal Year

This dropdown menu is used to move the selected period to another fiscal year.

This option would typically only be used during the implementation of the accounting application or to reconfigure periods within fiscal years that do not match the calendar year.

Grid Columns

Period No

This column identifies each period within the selected fiscal year.

- By default Period Numbers represent the year in which the period exists and the month that it represents.

- Examples: January of 2017 = 201701; June of 2025 = 202506, etc.

- Periods are set to match calendar months by default, but this can be changed by selecting a different Fiscal Year Type.

- If you need to switch from the current Fiscal Year Type, it is important to do so BEFORE any accounting records are entered into the fiscal year.

- Period Numbers can be edited, but they must be unique between all fiscal years.

- Each fiscal year will have an “extra” adjustment period that can be used for year end adjustments regardless the Fiscal Year Type selected. Adjustment periods:

- Cannot be deleted or removed from the fiscal year

- Are labeled Adjustment and do not reference a specific month

- Do not have a Begin or End Date

- Display as the "13th" period unless you have edited the year to contain more than 12 periods. In that case, it will be the last period displayed.

Month

This identifies which month the period represents for accounting purposes.

- The system designates the month based on the date range selected.

Status

This value represents the period's status regarding the ability to enter accounting records into it.

- Status pulls from Process Accounting Functions (GL > Journals > Process.) Options include:

- POSTED

- UNPOSTED

- LOCKED

Begin Date

This date is used to determine which month should be associated with the period.

- The user can edit the Begin Date for e period, however each Period must begin on the first day of a month.

End Date

This value represents the last day associated with the period.

- End Date is calculated by the system and is populated based on the Begin Date, but can be adjusted.

- If you adjust Begin or End Dates, make sure you do not leave a gap between periods.