Tables

Create a Vendor Code

System Location: Settings > Tables > Vendors

Vendor Codes provide the means to store contact and credit information for businesses that parts and / or services are purchased from.

For additional details on the fields covered here, along with information for those that are not, please see Tables > Vendors in the help file.

- Click the Settings button.

- Open the Tables dropdown menu.

- Select Vendors.

- Click New (located at the top of the page.)

Provide Values

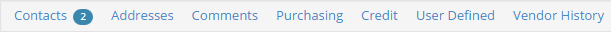

Provide information for the fields listed below at a minimum to take advantage of JobBOSS2's reporting and analysis tools in addition to benefiting from its ability to pass information along from one part of the software to another. The Header Areas referenced can be accessed by scrolling down the page or by clicking the appropriate option in the Header Navigator Bar (pictured.)

The User-Defined Section and related information will only be available if the User has been granted adequate permissions within User Maintenance.

General Header

An asterisk [*] indicates a required field.

- Provide information as appropriate:

- *Vendor Code: Must be unique

- Vendor Name: Appears on purchase orders and delivery tickets

- Phone Number: Main company phone number for the vendor

- Vendor Type: Used to categorize like vendors

- *Currency Code: Determines the currency used for financial transactions with the vendor

Contacts Header

- Click Add Row (located above the grid) to enter a new contact for the vendor.

- Provide information as appropriate:

- A/R (check box): Select if this contact is responsible for dealing with accounts receivable related issues for the vendor

- A/R Contacts are the ones to call regarding issues with A/P invoices received from and cash disbursements sent to the vendor

- Phone Number: Can edit if contact has a direct number different than the company’s number

- Ext: The Contact’s phone extension

- Email Address: This can be used to email forms and reports from within JobBOSS2 to the contact

- A/R (check box): Select if this contact is responsible for dealing with accounts receivable related issues for the vendor

- Add as many rows as needed by repeating the steps above.

Addresses Header

Shipping Address: Location manufactured parts are sent to for servicing

- Use Line 1 and Line 2 to indicate the physical street address as needed.

- Enter a valid ZIP / Postal Code.

- The system will automatically fill in the remaining address fields when a valid Postal Code for the United States or Canada is provided.

- The Purchasing and Remittance Address areas will automatically populate with the information provided in the Shipping Address area by default, but can be edited as needed. Note that entering a Postal Code for an address that is already present does not automatically populate the remaining fields; they will all need to be edited accordingly.

Purchasing Address: Location material is purchased from

Remittance Address: Location cash disbursements are sent to

- Edit address information if needed (see note above)

Comments Header

- Provide information as appropriate:

- Comments to Vendor: This information will appear on correspondence and printed forms sent to the vendor

- Comments About Vendor: This information is internal to the vendor file

Purchasing Header

- Provide information as appropriate:

- Outside Service Vendor?: Identifies whether the vendors provides an outside service

- Yes = Vendor provides outside services

- No = Vendor does not provide outside services

- Print Delivery Ticket?: Determines whether a delivery ticket will be printed to accompany items sent to an outside vendor

- Yes = Delivery ticket will automatically print with purchase orders marked as an outside service created for vendor

- No = Delivery tickets will not be printed

- Outside Service Vendor?: Identifies whether the vendors provides an outside service

Credit Header

- Provide information as appropriate:

- GL Expense Account: The default expense account used on purchase orders created for this vendor

- Terms Code: Terms offered by vendor with regards to payment of invoices

- Terms Code is a required field on A/P invoices

- May be required on vendor if an accounting interface is used

- Sales Tax Code: Default tax code used on purchasing related transactions

- Tax Code is a required field on A/P invoices.

- It is recommended to create an EXEMPT Tax Code for use with financial transactions that do not require the collection of taxes.

- Click 'Save' to save and close the record.

- Use the Save dropdown menu if you want to create a new record or print a report upon saving.