Tables

Bank Codes

System Location: Settings > Tables > Bank Codes

Bank Codes allow the system to track deposits to and withdrawals from specified cash accounts. These "linked" transactions create a Checkbook Register for each associated account that is used for Bank Reconciliation purposes.

Bank Codes are required on cash transactions (Cash Receipts / Cash Disbursements) created in JobBOSS2, so it is recommended that a default Bank Code be designated for AR and AP purposes in Company Maintenance Defaults.

Related Tables

The following Tables and / or Base Tables are used on Bank Codes (an asterisk [*] indicates it is a required field on this Table):

- *GL Codes

- *Currency Codes

Associated Reports

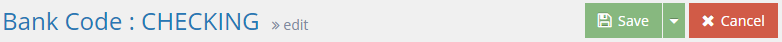

The Record Header located at the top of the page indicates which specific record has been selected and for what purpose (new, edit, quick view) and displays record specific Action Buttons (discussed below.)

For more information see User Interface.

Action Buttons

Save (button)

Save Button Details

This button is used to close the record and save any changes that have been made while it was open. In addition, the dropdown button allows you to Save and:

- Close - close the open record.

- New - open a new blank record.

- Print - print any of the reports related to the open record.

Cancel (button)

Cancel Button Details

This button is used to close the record without saving any changes that may have been made while it was open. If this button is used after a change has been made to the record, the system prompts to verify whether the record should be closed without saving the changes.

Answering "Yes" to the prompt closes the record without saving the changes.

Answering "No" to the prompt leaves the record open.

Back to Top

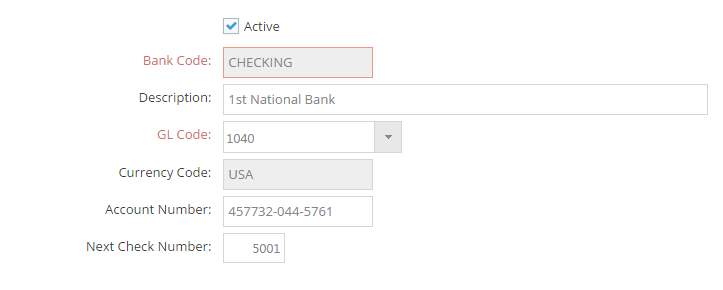

An asterisk [*] indicates a required field.

Active

Checking this box indicates the bank code should be considered as an active account.

- Only active bank codes display when selecting Checkbook Registers under AP Reports

- Remove check for bank codes that are no longer open

- Remain in system as a Bank Code Table records for reference and reconciliation purposes

- Still displays in Bank Code Navigator

Bank Code

This value is the "short name" assigned to the bank code.

- Can be up to 12 alpha-numeric characters

- Must be unique for each bank code

Description

This is the "long name" for the bank code that appears on reports and forms for reference.

- Can be up to 30 alpha-numeric characters

- Does not need to be unique

*GL Code

This is the general ledger account the check register for the bank code pulls information from for reconciliation purposes.

- A GL code should not be associated with more than one bank code

*Currency Code

This determines the currency that associated cash transactions will be tracked in.

- Populates automatically when the GL code is selected

- Cannot be edited on the bank code

Account Number

Use this field to track the account number assigned to each bank account by the financial institution.

- Can be up to 30 alpha-numeric characters

- Used for reference only

Next Check Number

This represents the number that will be assigned to the next Cash Disbursement transaction (check) created within JobBOSS2.

- Only numeric values are allowed

- If left blank the system will assign a value of zero (0) one the next cash disbursement

- The system automatically increments this value forward by 1 after each cash disbursement is created

Back to Top