SFC; Misc Job Costs

Miscellaneous Job Costs

System Location: Data Entry > Shop Floor Control > Misc Job Costs

Miscellaneous job costs are used to capture costs against jobs that do not come through any of the following methods:

- Time Ticket (Labor and Burden Costs)

- Purchase Order / Receiver (Material or Service Costs)

- Inventory Transfer (Material Cost)

Miscellaneous job costs are particularly useful when first implementing JobBOSS2 as a way to capture costs from the system being replaced.

The following Tables and / or Base Tables are used on miscellaneous job costs (an asterisk [*] indicates it is a required field on this Table):

- GL Code

- Product Code

- Vendor Code

The following reports are available in the Navigation Sidebar under Reports > Cost Analysis:

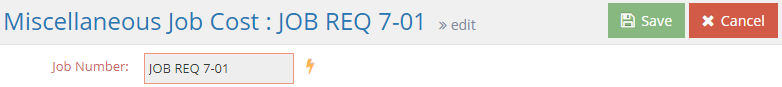

The Record Header located at the top of the page indicates which specific record has been selected and for what purpose (new, edit, quick view), provides access to shortcuts to the various Sections of the record (located in the Anchor Bar), and displays record specific Action Buttons (discussed below.)

For more information see User Interface.

Action Buttons

Save (button)

Save Button Details

This button is used to close the record and save any changes that have been made while it was open. In addition, the dropdown button allows you to Save and:

- Close - close the open record.

- New - open a new blank record.

- Print - print any of the reports related to the open record.

Cancel (button)

Cancel Button Details

This button is used to close the record without saving any changes that may have been made while it was open. If this button is used after a change has been made to the record, the system prompts to verify whether the record should be closed without saving the changes.

Answering "Yes" to the prompt closes the record without saving the changes.

Answering "No" to the prompt leaves the record open.

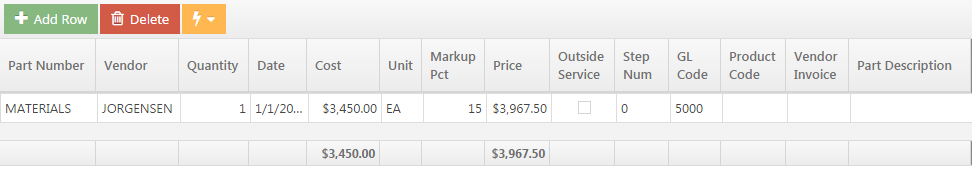

The image above provides an example of entering the material costs incurred on an open job entered into JobBOSS2 during the initial implementation phase.

The Miscellaneous Job Cost Grid can be used to enter the necessary information to identify the cost(s) being applied to the selected job.

Part Number

This value is used to identify the type of cost being entered.

- Information is entered by typing directly in Part Number field

- The value entered can be the same as one defined in JobBOSS2, but often it is not

- Entering an "undefined" part here does not add it to the part file

Part Description

This field can be used to provide additional details about the type of cost being entered.

- Information will not auto populate even if a defined part number is manually entered in the 'Part Number' field

Vendor

This field is used to identify the external business that provided the material or service.

Quantity

This numeric value indicates how many units of the listed item should be costed to the selected job.

- When entering costs during the initial implementation of JobBOSS2, it is common to have a 'Quantity' of 1 that represents the total amount of material, labor, services, etc.

- In these scenarios, the associated 'Cost' would represent the total cost for the listed item

Date

This is the date the cost was incurred.

- Defaults to the current date but can be changed

Cost

This is the cost of the listed 'Part Number.'

- This would typically be entered in terms of the listed 'Unit', but may represent the total cost if the line is used to aggregate costs for similar items (see details on Quantity above)

Unit

This value is used to provide reference for the listed 'Cost.'

Markup Pct

This value is applied to the 'Cost' entered in order to calculate a 'Price' for the listed item.

Price

This calculated value is used to help determine a sales value for time and material jobs (as displayed on a Job Cost Summary.)

Outside Service

When checked, the system considers the miscellaneous cost as an outside service.

- This designation can be used to provide breakout details on costing reports such as the Job Cost Summary

Step Number

Use this field to associate the cost with a specific step.

GL Code

This value is used on various reports to help identify how the cost should be classified for accounting purposes.

- When using miscellaneous costs to capture "grouped costs" during implementation, GL Code breakdown is often the deciding factor when determining how many entries are needed.

- For example, as opposed to one entry for all material, it may be beneficial to enter an entry for each GL Code designation of material used.

- If GL Code is left blank, reports such as the Job Cost Summary will display "UNKNOWN" or leave the GL Code field blank.

Product Code

This can be used to categorize the miscellaneous cost.

Vendor Invoice

This field is populated by the system when a miscellaneous cost is entered through a vendor invoice.