Base Tables

Terms Codes

System Location: Settings > Base Tables > Terms Codes

Terms Codes are used to calculate discount related information and net due dates for customer and vendor transactions. While terms codes are optional on orders and purchase orders, they are required on customer and vendor invoices for those that have the Accounting Application.

For information about the Accounting Application, please contact sales at 1-800 525 2143.

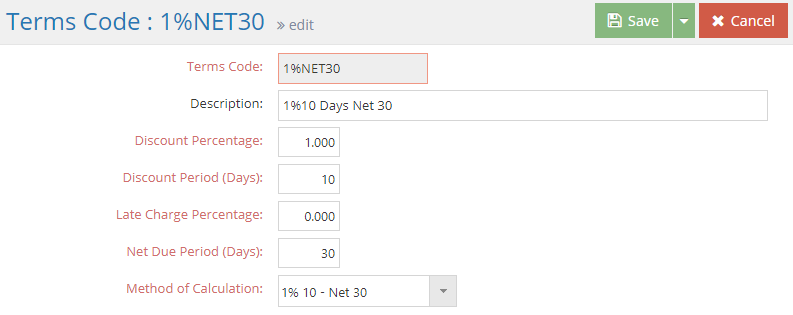

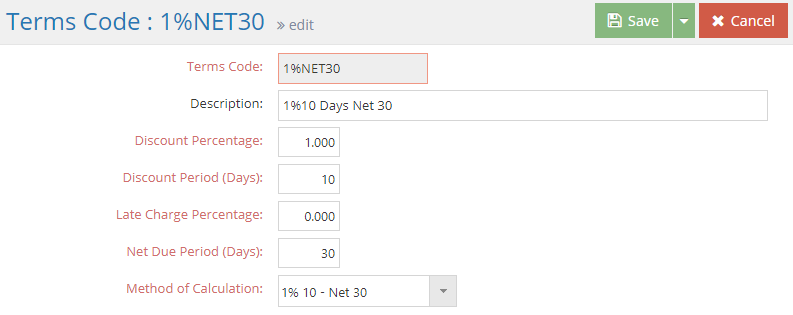

The Record Header located at the top of the page indicates which specific record has been selected and for what purpose (new, edit, quick view) and displays record specific Action Buttons (discussed below.)

For more information see User Interface.

Action Buttons

Save (button)

Save Button Details

This button is used to close the record and save any changes that have been made while it was open. In addition, the dropdown button allows you to Save and:

- Close - close the open record.

- New - open a new blank record.

- Print - print any of the reports related to the open record.

Cancel (button)

Cancel Button Details

This button is used to close the record without saving any changes that may have been made while it was open. If this button is used after a change has been made to the record, the system prompts to verify whether the record should be closed without saving the changes.

Answering "Yes" to the prompt closes the record without saving the changes.

Answering "No" to the prompt leaves the record open.

Back to Top

An asterisk [*] indicates a required field.

*Terms Code

This is the "short name" assigned to the terms code by the user.

- Must be unique

- Can be up to 12 alpha-numeric characters in length

- Should indicate the terms being offered

Description

Use the description to provide additional information about terms being offered.

- Can be up to 30 alpha-numeric characters in length

- Appears on Terms Code Navigator and various reports for reference

*Discount Percentage

Enter the amount of discount being offered if invoices associated with the code are paid within the stated discount period.

- Must be a value between 0 and 99.99

When entering percentages in JobBOSS2, enter the value as a "standard" number instead of the decimal equivalent. For example, if the value should be five percent, simply enter "5" as opposed to ".05"; the system will automatically convert the value accordingly.

*Discount Period (Days)

Enter the number of days within which the invoice must be paid in order to receive the stated discount.

- Must be a value between 0 and 999

- Used to calculate the discount date of AR and AP invoices based on the Method of Calculation selected

*Late Charge Percentage

Enter the amount of the penalty to assess on AR invoices if they are not paid within the stated net due period.

- Must be a value between 0 and 99.99

- Only used if the Finance Charge Utility is used under the AR portion of the system

When entering percentages in JobBOSS2, enter the value as a "standard" number instead of the decimal equivalent. For example, if the value should be five percent, simply enter "5" as opposed to ".05"; the system will automatically convert the value accordingly.

*Net Due Period (Days)

Enter the number of days within which the invoice must be paid before it is considered to be late.

- Must be a value between 0 and 999

- Used to calculate the Due Date of AR and AP invoices based on the Method of Calculation selected

*Method of Calculation

Select how the system will use the Discount Period and Net Due Period values to calculate Due Dates and Discount Dates on AR and AP invoices.

- Method 1: Uses the Invoice date and adds the number of days from the Discount Period and Net Due Period fields to calculate the Discount Date and Due Date, respectively

- Method 2: Assigns the value entered in the Discount Period and Net Due Period fields as the Discount Date and Due Date, respectively

Back to Top