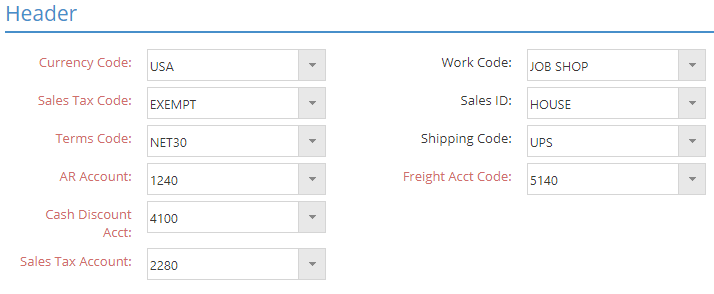

Billing Header Section

The Header section displays information about related GL accounts and tax codes. The asterisks (*) below indicate required fields.

*Currency Code

This field represents the currency in which the invoice is being billed and is expected to be paid in.

*Sales Tax Code

This field provides the tax rate to apply for any item marked eligible to be taxed (Line Item Section)

- In order for taxes to be calculated and applied, the following conditions must be met:

- At least one Line Item must be marked as 'Taxable: Yes'

- The Sales Tax Code must have a tax rate greater than 0

*Terms Code

This field determines whether a discount can be taken and what the discount time frame / amount would be in addition to setting the final Due Date.

*AR Account

This field represents the GL Code used to track outstanding AR amounts.

*Cash Discount Account

This field represents the GL Code used to account for any discounts taken due to being paid within stated terms.

*Sales Tax Account

This field represents the GL Codes used to account for / track any sales taxes paid on the invoice.

- This would typically be a liability account to represent the appropriate taxing authority.

Work code

This represents the default Work Code assigned to each line item.

- Different Work Codes can be assigned in Line Item Details.

Sales ID

This field indicates the salesperson associated with the invoice for commission purposes.

- Commission Percent is designated in Line Item Details.

Shipping Code

This field indicates the shipping method used for this invoice.

*Freight Account Code

This field represents the GL Code used to account for any Ship Charges listed in the General Section.

| Back to Billing Details - Line Items Section | Return to Customer Billing | Go to Billing Details - Payments Section |